StayliaDXB Blog

Expert insights, market analysis, and investment tips to help you build wealth through Dubai real estate.

Have you noticed something? Every agent. Every Instagram ad. Every property exhibition. Every "exclusive launch event." They all push off-plan. I cannot remember the last time an agent proactively tried to sell me a ready property. Not once. Why? Because the entire marketing budget in Dubai goes to off-plan. Developers spend millions on brochures, renders, launch events, influencer partnerships. They control the conversation. And when you're outspent, you lose the narrative war. But numbers don't lie. Let me show you what's actually happening.

A framework for understanding why 90% of Dubai investors underperform—and how to avoid joining them.

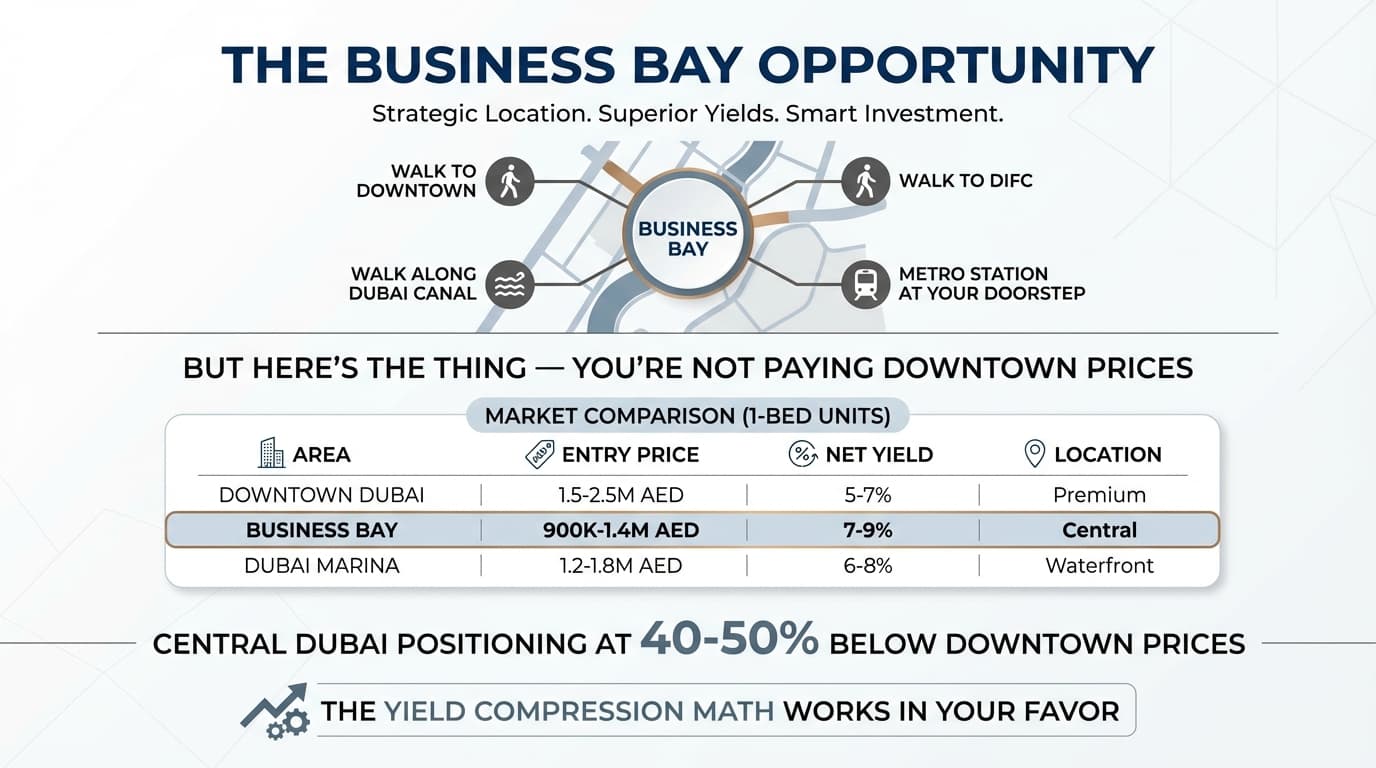

I pulled the DXB Interact numbers for Business Bay last week. Specifically Aykon City — one of the area's flagship developments. Here's what I found: Median price per sqft: 1,860 AED (-8% YoY) Transaction volume: 82 deals (+58% YoY) Prices down. Transactions up. That's not a market in distress. That's a market where smart money is positioning while retail investors chase the same tired Marina and Palm narratives. Let me show you why Business Bay deserves your attention right now.

I've been investing in Dubai real estate for years. Nine properties. All secondary market. And one of the areas I keep coming back to is one that most flashy Instagram agents ignore completely. It's not Marina. It's not Downtown. It's not Palm. It's the neighborhood sitting right across the road from Marina — with yields 1.2x higher and entry prices 25-30% lower.

Dubai Marina is probably the most recognized address in the Middle East. Waterfront towers. Yacht clubs. Walking distance to JBR beach. When people picture Dubai real estate, they picture Marina. It's also where I see investors make the most expensive mistakes. I pulled the latest DXB Interact transaction data last week. What I found wasn't surprising — but the gap was wider than even I expected. Off-plan buyers in Marina are paying 91% more per square foot than secondary market buyers. Same neighborhood. Same views. Same lifestyle. Nearly double the price.

Learn the exact 5 criteria for analyzing Dubai rental properties before you buy. From an investor with 9 cash-purchased properties—not another agent pitch.

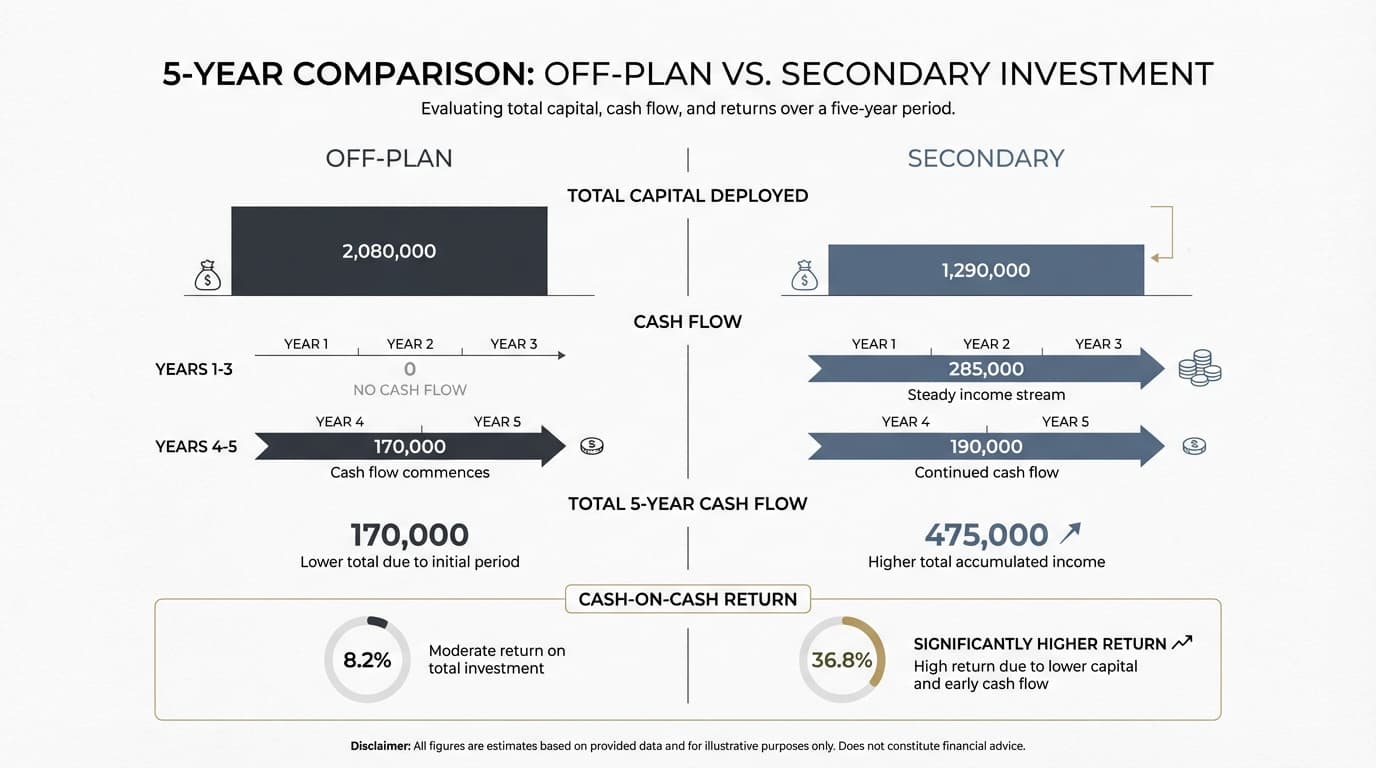

Off-plan buyers pay 45% more than secondary market. Here's the data proving Dubai's off-plan market is designed to extract wealth from investors, not build it.

Most Dubai properties are stuck at 5-6% yield—or worse. Learn the three mistakes killing your returns and the operational strategy that delivers 10%+ net profit annually.

Learn the exact 11-step framework for finding Dubai rental properties yielding 10-13% ROI. From an active investor with 9 properties—not another agent pitch. Dubai rental property ROI, Dubai Airbnb investment, Dubai real estate investment strategy, high-yield Dubai property, Dubai short-term rental returns

Dubai's tenant protection laws strip landlords of control. Learn why savvy investors are abandoning long-term rentals—and the asset control strategy delivering 10%+ returns instead.