UBS released data showing Dubai apartments pay back their value through rent faster than any other global city analyzed.

But here's what most people miss: the difference between areas within Dubai is massive.

A villa on Palm Jumeirah sounds impressive. It often brings 3% yield. Some areas in Dubai generate double that — or more — if you know where to look.

I've been investing in Dubai real estate for years. Nine properties. All secondary market. And one of the areas I keep coming back to is one that most flashy Instagram agents ignore completely.

It's not Marina. It's not Downtown. It's not Palm.

It's the neighborhood sitting right across the road from Marina — with yields 1.2x higher and entry prices 25-30% lower.

Let me show you why JLT deserves serious attention.

The Math That Makes JLT Work

Here's what the rent-to-price ratios look like in JLT:

Unit TypeRent-to-Price RatioStudio8.5%1-Bedroom7.5%2-Bedroom6.6%3-Bedroom5.8%

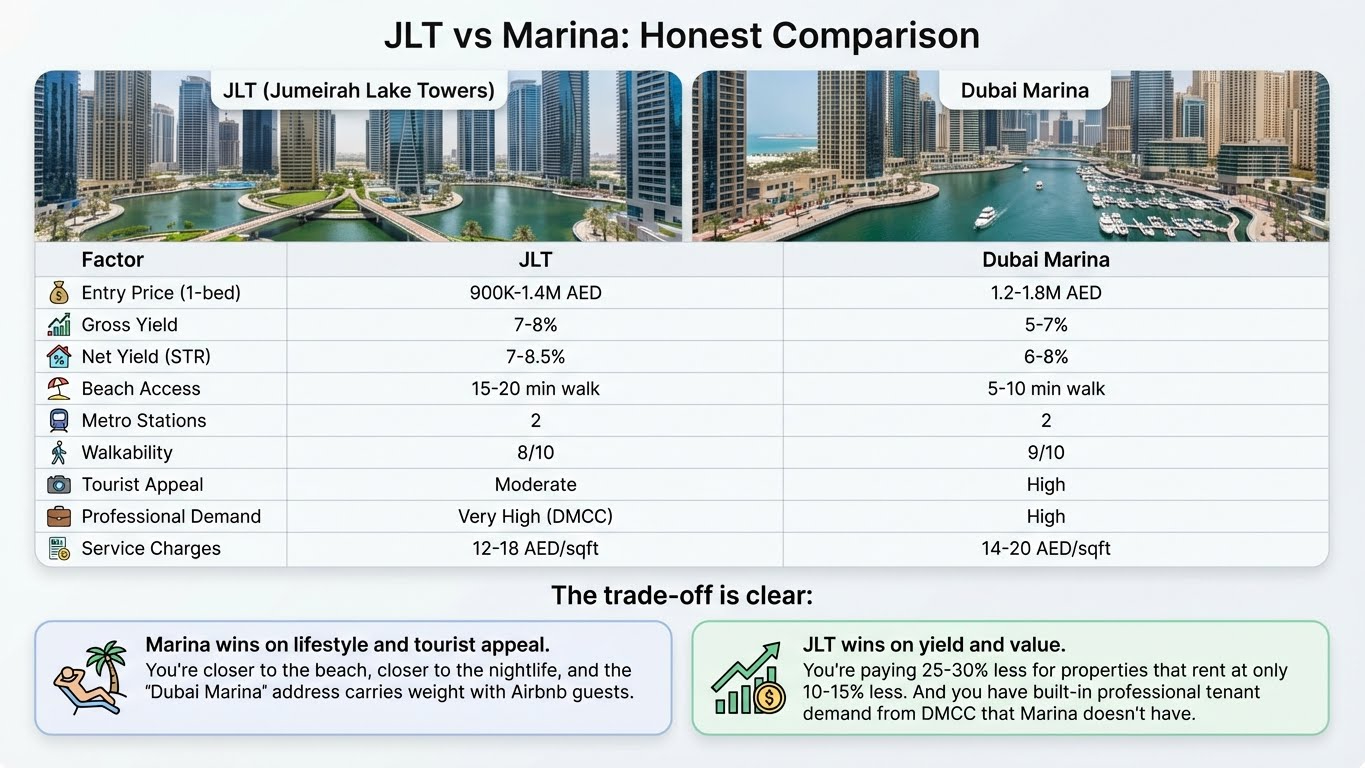

Compare that to Marina where you're looking at 5.5-6.5% gross on similar units.

Or Palm Jumeirah where investors often see 3-4%.

The gap is significant. And it exists for reasons that actually make sense when you understand the market.

Why JLT Yields Are Higher

1. Lower entry prices, similar rents

An average ready studio in JLT runs around 600-850K AED. That's 25-30% cheaper than Marina.

But here's the thing — rental rates aren't 25% lower. They're maybe 10-15% lower.

When you pay less to acquire but collect nearly the same rent, your yield compresses upward. Basic math that most buyers ignore because they're chasing prestige over returns.

2. Location is actually strong

JLT sits directly across Sheikh Zayed Road from Marina. Walking distance to:

Marina Walk and restaurants

JBR Beach (15-20 minute walk)

Bluewaters Island

Two metro stations (DMCC and Sobha Realty)

The metro gets you to Downtown in 26 minutes. That matters for tenants who work in DIFC or Business Bay.

3. DMCC free zone creates unique demand

This is something most investors completely miss.

Dubai has over 30 free zones. DMCC (Dubai Multi Commodities Centre) is one of the largest — and it's headquartered in JLT.

What does DMCC do? It's the free zone for commodities trading. Gold traders. Diamond merchants. Coffee importers. Companies that qualify for 0% corporate tax.

There are 23,000+ companies registered in DMCC.

All these traders and their employees need somewhere to live. And they want to live close to work.

This creates consistent demand for both budget-friendly apartments (for junior staff) AND high-end units (for executives and business owners).

JLT isn't just "affordable Marina alternative." It's a genuine commercial hub with built-in tenant demand that most residential areas don't have.

What I Look For in JLT

Not all JLT buildings are equal. The area has 26 clusters (A-Z), each with multiple towers. Quality and yields vary dramatically.

Best clusters for investment:

Clusters B, C, D — Near DMCC Metro station. Highest demand from professionals. Walking distance to offices.

Clusters R, S, T — Near Sobha Realty Metro. Good connectivity, mix of residential and commercial.

Clusters F, G, H, J, K — Lake-facing. Premium views command higher rates. More family-oriented.

Buildings that perform (7-8% net achievable):

What I avoid:

Very old buildings with dated finishes and deferred maintenance

Commercial-heavy clusters with limited residential appeal

Buildings with service charges above 20 AED/sqft

Towers far from metro with parking problems

JLT vs Marina: Honest Comparison

The trade-off is clear:

Marina wins on lifestyle and tourist appeal. You're closer to the beach, closer to the nightlife, and the "Dubai Marina" address carries weight with Airbnb guests.

JLT wins on yield and value. You're paying 25-30% less for properties that rent at only 10-15% less. And you have built-in professional tenant demand from DMCC that Marina doesn't have.

The Tenant Profile Difference

Who actually rents in JLT?

The professional tenant base is JLT's secret weapon.

These aren't tourists looking for the cheapest Airbnb. They're people on work contracts, corporate relocations, project assignments. They book for weeks or months, not days.

Longer stays = lower turnover = higher net yield after operating costs.

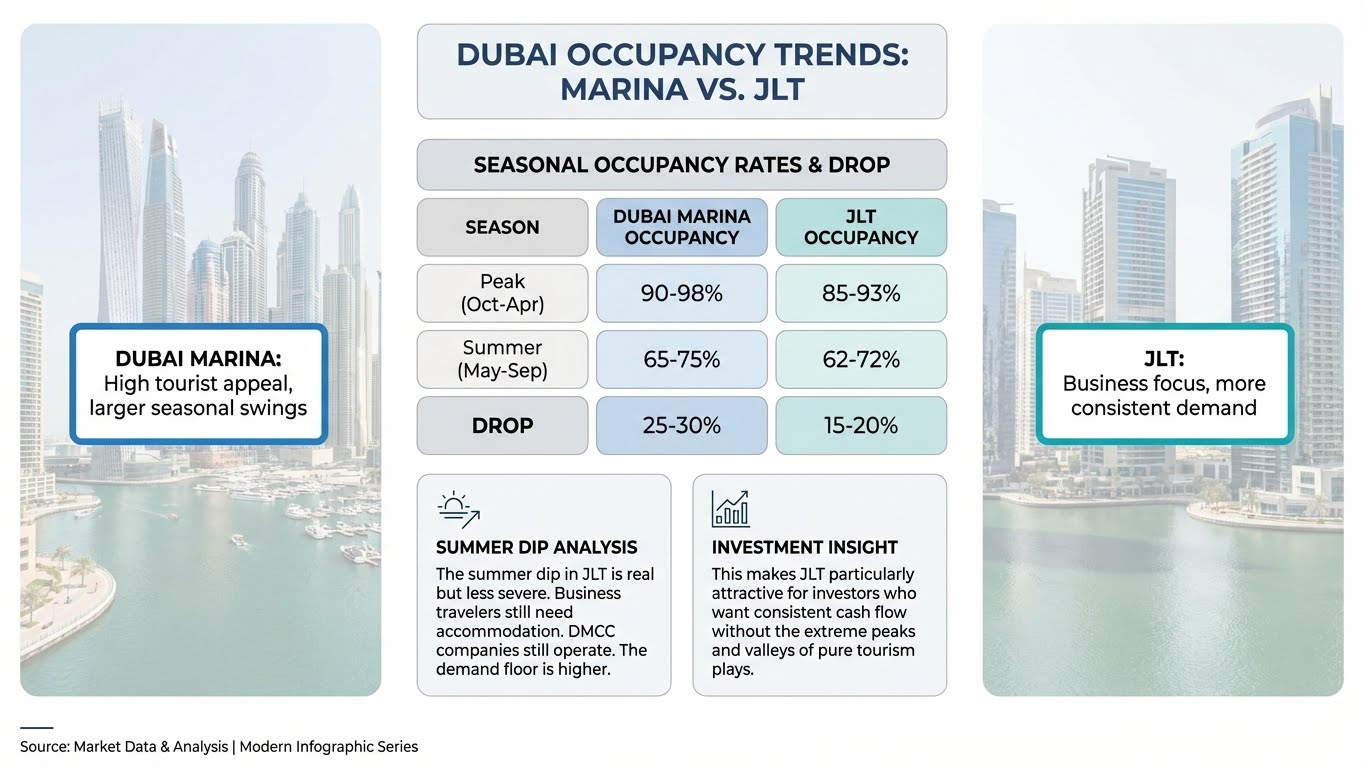

The Seasonal Reality

JLT has less seasonal volatility than tourist-heavy areas.

Why? Because corporate travel doesn't stop in summer the way tourism does.

The summer dip in JLT is real but less severe. Business travelers still need accommodation. DMCC companies still operate. The demand floor is higher.

This makes JLT particularly attractive for investors who want consistent cash flow without the extreme peaks and valleys of pure tourism plays.

A Real JLT Investment Scenario

Let me walk through actual numbers:

Acquisition:

Building: Lake-facing 1-bedroom in Cluster J

Purchase price: 1,050,000 AED (9% below asking via motivated seller)

Renovation: 42,000 AED

Total investment: 1,092,000 AED

Operations (Blended STR/Monthly):

Gross revenue: 118,000 AED/year

Operating costs (50%): 59,000 AED

Net operating income: 59,000 AED

Net yield: 5.4%

Compared to Marina equivalent:

Similar 1-bed in Marina: 1,400,000+ AED total investment

Similar net operating income: 65,000 AED

Net yield: 4.6%

JLT delivers better yield on lower capital. The difference compounds over time.

Why JLT Gets Overlooked

Three reasons:

1. No "wow" factor

JLT doesn't have the Instagram appeal of Marina or Palm. There's no iconic skyline shot. No beach in the frame. It's lakes and mid-rise towers.

Investors who buy based on prestige skip it entirely.

2. Agents don't push it

Commission is commission — 2% whether you sell a 900K JLT apartment or a 1.8M Marina apartment.

But Marina is easier to sell. The story tells itself. "Waterfront living in Dubai Marina" closes deals.

"Affordable alternative near DMCC free zone" doesn't have the same ring.

3. Confusing layout

26 clusters. 80+ towers. No clear "best building" that everyone knows.

Compared to Marina where agents can point at Princess Tower or Marina Gate and call it a day, JLT requires actual knowledge of which clusters and buildings perform.

Most agents don't have that knowledge. So they don't recommend it.

Who JLT Is Actually For

JLT makes sense if:

You're optimizing for yield over prestige

You have 900K-1.4M AED to deploy

You want professional tenant demand, not just tourists

You're comfortable with "Marina adjacent" instead of "Marina address"

You value metro access and walkability

JLT doesn't make sense if:

You need the Marina/Palm address for personal use

Tourist appeal is critical to your STR strategy

You're buying primarily for appreciation (Marina likely wins)

You want to self-manage remotely (JLT's professional tenants have high expectations)

The Bottom Line

JLT is Marina's smart neighbor.

You sacrifice 10-15 minutes of beach proximity and some Instagram appeal. You gain 25-30% lower entry prices and 1-2% higher yields.

For investors focused on cash flow over status, the math is clear.

The data shows Dubai apartments pay back faster than any other global city. But within Dubai, the gap between 3% Palm yields and 8% JLT yields is the difference between a mediocre investment and a genuine wealth-building asset.

JLT isn't sexy. It's just profitable.

For serious investors:

I work with a small group of investors who want to execute correctly in JLT and other high-yield Dubai areas. Secondary market only. Below-market purchases from motivated sellers. Professional operations.

If you understand why yield matters more than prestige, we should talk.

Investor to investor. Not agent to buyer.

CTA 1 will appear here

Topics

Related Articles

View all

How to Find 10-13% ROI Rental Properties in Dubai: An Investor's Framework

Learn the exact 11-step framework for finding Dubai rental properties yielding 10-13% ROI. From an active investor with 9 properties—not another agent pitch. Dubai rental property ROI, Dubai Airbnb investment, Dubai real estate investment strategy, high-yield Dubai property, Dubai short-term rental returns

8 min read

Why Dubai Long-Term Rentals Are a Trap for Serious Investors (And What Actually Works)

Dubai's tenant protection laws strip landlords of control. Learn why savvy investors are abandoning long-term rentals—and the asset control strategy delivering 10%+ returns instead.

8 min read

The Dubai Safety Net: How High-Net-Worth Investors Build 10%+ Tax-Free Cash Flow

A framework for $10M+ investors to build tax-free, cash-flowing real estate portfolios in Dubai. From an investor with multi-8-figure holdings—not another agent pitch.

9 min read