If you've looked at Dubai real estate for more than five minutes, you've been pitched an off-plan deal.

A glossy brochure. Renders of infinity pools overlooking the Palm. "Launch pricing" with "guaranteed appreciation." Payment plans that make a $2 million apartment feel like a Netflix subscription.

The agent is enthusiastic. The developer name is recognizable. The location sounds promising.

And if you're like most investors, you're tempted.

I was too. Years ago, I bought off-plan. I believed the projections. I trusted the timeline. I thought I was getting in early.

I was wrong.

That single mistake taught me more about Dubai real estate than any success I've had since. And the data I've pulled since then confirms what I learned the hard way:

Off-plan is where sophisticated investors go to become average.

Let me show you why—with actual numbers, not marketing claims.

The Pitch vs. The Reality

Here's what off-plan looks like when an agent presents it:

"Launch pricing" at "below market rates"

3-5 year payment plan (only 20% upfront!)

"Prime location" with "guaranteed appreciation"

Developer track record and brand prestige

Projected rental yields of 8-10%

Here's what off-plan actually looks like when you examine the data:

Prices 40-90% above comparable secondary market units

3-5 years of capital tied up with zero cash flow

Location that won't have infrastructure for years

Developer delays, specification changes, and handover surprises

Actual yields of 4-6% (if you're lucky)

I pulled the DXB Interact transaction data for Dubai Marina last month. The numbers are stark.

Off-plan median price per sqft: 3,470 AED Secondary market median price per sqft: 1,810 AED

That's a 91% premium for off-plan over secondary market properties in the same area.

Read that again. Off-plan buyers are paying nearly double for apartments in Dubai Marina compared to what they could pay for existing, ready-to-rent units.

This isn't a small difference. This is the difference between a profitable investment and a money pit.

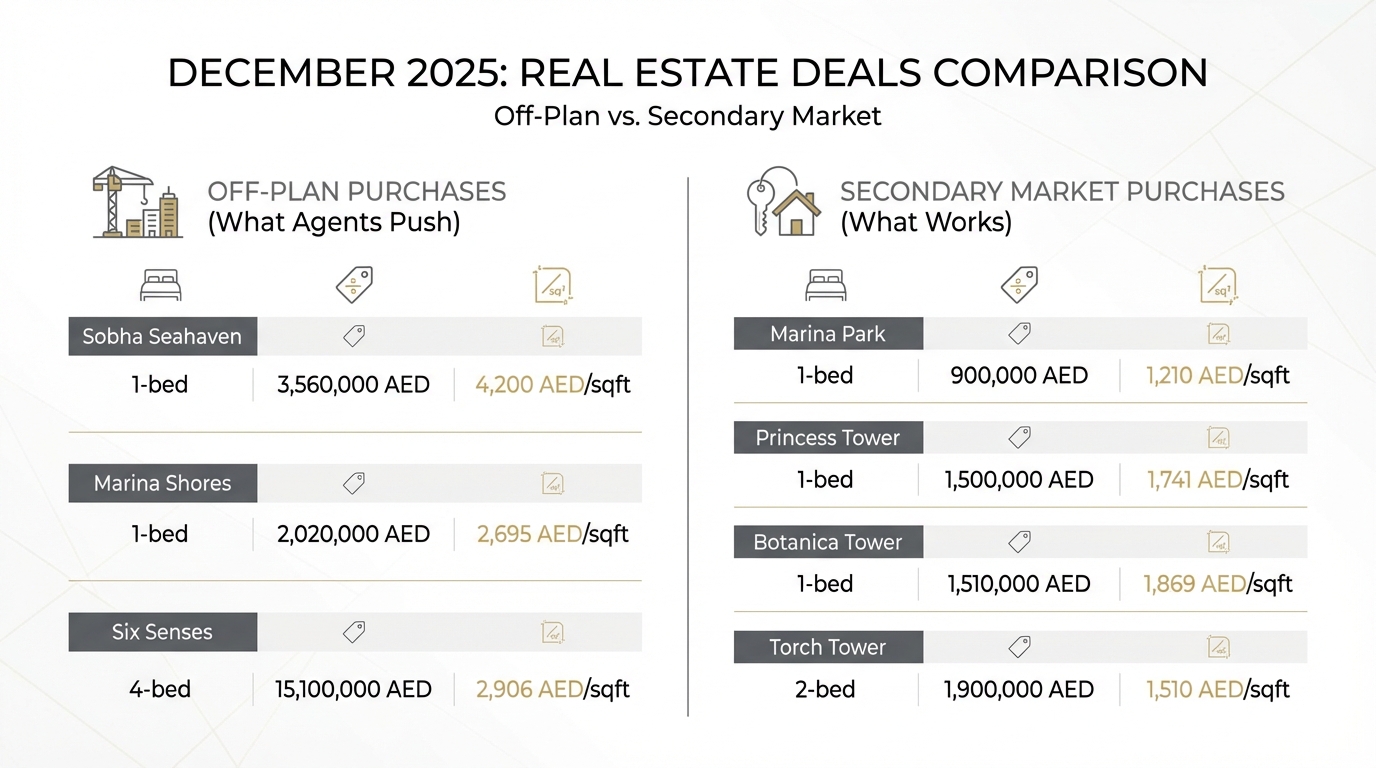

Real Transactions: What Investors Actually Paid

Let me show you specific deals from December 2025.

Look at those numbers.

A one-bedroom in Sobha Seahaven (off-plan) costs 3.56 million AED at 4,200/sqft.

A one-bedroom in Princess Tower (secondary, ready, established demand) costs 1.5 million AED at 1,741/sqft.

The Marina Park buyer paid 900K for a one-bedroom at 1,210/sqft.

Same neighborhood. Same tenant pool. Same beach proximity.

The off-plan buyer paid 2-3x more for an apartment that won't generate a single dirham of income for three years.

How does this make any sense?

The Incentive Problem Nobody Talks About

It makes sense when you understand who benefits.

Off-plan developments pay agents 5-7% commission.

Secondary market properties pay agents 2%.

If you're an agent, which deal do you push?

A 2 million AED off-plan sale puts 100,000-140,000 AED in an agent's pocket.

A 1 million AED secondary sale puts 20,000 AED in their pocket.

The agent makes 5-7x more money selling you the worse investment.

This isn't conspiracy. It's just math. And once you see it, you can't unsee it.

Every "exclusive launch event." Every "limited time pricing." Every "VIP allocation." It's all designed to move off-plan inventory because that's where the commissions are.

I hate 99% of Dubai agents. Not because they're bad people—because their incentives are structurally misaligned with investor outcomes. They don't understand investor pain points because they've never been investors themselves. They sell what pays them.

The strategy that actually works is the opposite of what they pitch.

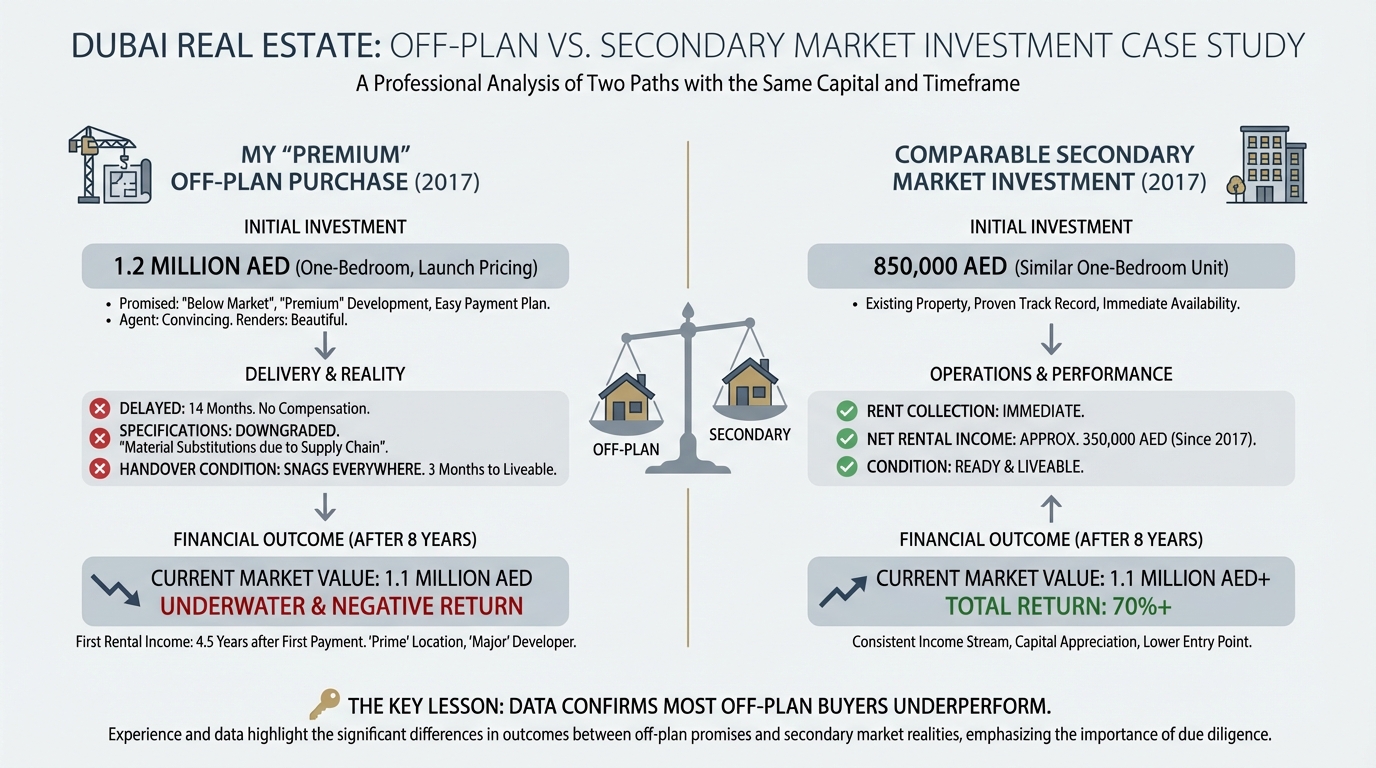

My Off-Plan Mistake

I'll tell you about my first Dubai purchase. I'm not proud of it.

A "premium" development from a major developer. The agent was convincing. The renders were beautiful. The payment plan was easy.

I bought a one-bedroom off-plan for 1.2 million AED. Launch pricing, they said. Below market, they said.

Here's what happened:

Delivery: Delayed 14 months. No compensation.

Specifications: Promised finishes were downgraded. "Material substitutions due to supply chain issues."

Handover condition: Snags everywhere. Took three months to get the unit liveable.

First rental income: Arrived 4.5 years after my first payment.

Current market value: 1.1 million AED.

I'm underwater. After nearly eight years. On a "premium" development from a "major" developer in a "prime" location.

Meanwhile, an investor who bought a similar secondary market unit in 2017 for 850K:

Started collecting rent immediately

Has earned approximately 350K in net rental income since

Property now worth 1.1M+

Total return: 70%+ vs. my negative return

Same capital. Same timeframe. Completely different outcomes.

That mistake cost me years of learning. The data I've compiled since then confirms I'm not alone—most off-plan buyers underperform.

The Data: Off-Plan Is Correcting

Here's what the market is telling us right now:

Dubai Marina (December 2025):

Off-plan median price: -23% year-over-year

Secondary market median price: +7% year-over-year

Off-plan transaction volume: -25% YoY Secondary transaction volume: -14% YoY

The market is figuring it out.

Off-plan prices are dropping because buyers are finally doing the math. Secondary prices are rising because informed capital is flowing there instead.

When off-plan falls 23% while secondary rises 7%, that's not random. That's price discovery. That's the market correcting a mispricing that agents created.

Sophisticated investors are accumulating secondary market properties while retail buyers chase off-plan discounts that aren't actually discounts.

Why Off-Plan "Discounts" Aren't Discounts

Agents love the phrase "launch pricing."

"You're getting in at developer prices before the market marks it up."

Let's examine this claim.

The Developer's Margin

Developers price off-plan to cover:

Land acquisition cost

Construction cost

Marketing budget (those glossy brochures aren't free)

Agent commissions (5-7%)

Developer profit margin (15-25%)

Risk premium for 3-5 year delivery

All of this is baked into your "launch price."

You're not buying below market. You're buying at the price that makes the developer wealthy.

The Payment Plan Illusion

"Only 20% down! 80% on handover!"

This feels like leverage. It's actually the opposite.

That 80% due on handover? You'll need to arrange financing or pay cash. If the market has dropped (like it did 2015-2020), you're completing on an asset worth less than your purchase price.

You have all the downside risk with none of the upside benefit of actual leverage.

Compare this to buying secondary:

Arrange mortgage upfront (75-80% LTV available)

Know exactly what you're buying

Start collecting rent immediately

Refinance to extract equity as value increases

Secondary market investors control their financing. Off-plan buyers are captive to developer payment schedules.

The Timeline Cost

A 2 million AED off-plan purchase with 3-year delivery:

Year 1-3: Zero income. Capital tied up. Year 3: Handover. Furnishing. Licensing. First guest: 6+ months after handover. Year 4: Finally generating income.

Total dead capital period: 3.5-4 years.

A 1.2 million AED secondary purchase:

Month 1: Close. Month 2-3: Renovate and furnish. Month 4: First guest.

Total dead capital period: 3-4 months.

The off-plan buyer waits 4 years to start earning. The secondary buyer has collected 4 years of rental income before the off-plan building even opens.

At 80K net annual income, that's 320K in cash flow the off-plan buyer never sees.

The Buildings That Actually Perform

Here's what I look for instead:

Prime locations only: Dubai Marina, Business Bay, Downtown, JBR, JLT. No exceptions. No "emerging areas."

8-10+ year old towers: Older buildings trade at discounts because Dubai buyers chase "new." That's irrational. I buy value.

Poor condition units: Dated finishes, worn fixtures, neglected maintenance. These sell 10-15% below comparable units in the same building.

Renovation to premium standard: Transform ugly units into top-tier rentals. This is where the yield premium comes from.

Buildings that deliver 7-10% net yields:

Marina: Marina Gate 1/2/3, Damac Heights, Princess Tower, Marina Wharf, Cayan Tower

Business Bay: Aykon City, Volante Tower, Executive Towers, Ubora Towers

JLT: Lake City Tower, Goldcrest Views, Icon Tower, Saba Tower

Downtown: Index Tower, Burj Views, The Residences (select units)

Every one of these buildings has established demand, proven operating history, and rental data you can verify.

No renders. No projections. No trust required.

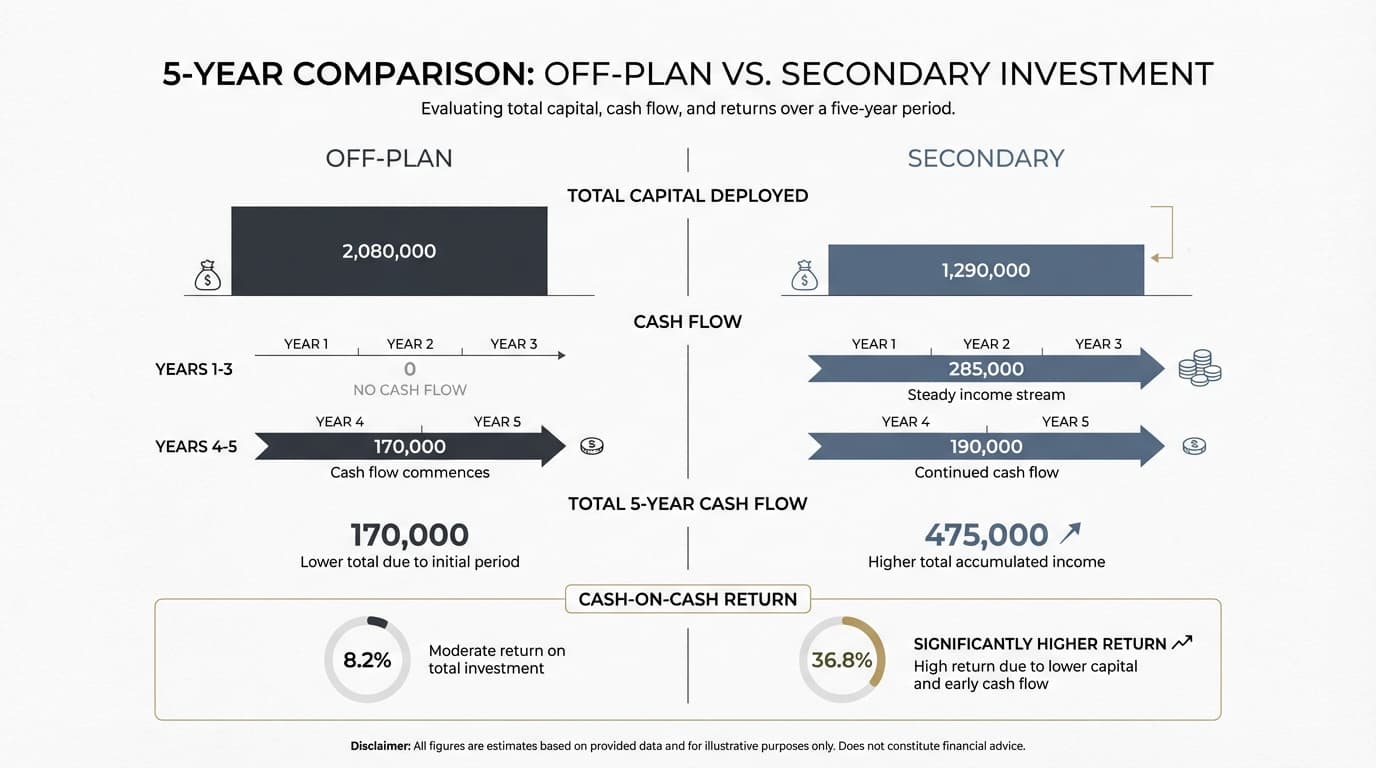

The Math: Secondary vs. Off-Plan

Let me run the numbers side by side.

Off-Plan Scenario:

Purchase: 2,000,000 AED (1-bed, premium off-plan)

Payment: 400K down, 1.6M on handover (Year 3)

Handover delay: 6 months (industry average)

Furnishing/setup: 80K

First income: Month 42

Annual net income (Year 4+): 85,000 AED

Net yield on total capital: 4.1%

Secondary Scenario:

Purchase: 1,200,000 AED (1-bed, older tower)

Renovation: 50,000 AED

Furnishing: 40,000 AED

Total investment: 1,290,000 AED

First income: Month 4

Annual net income: 95,000 AED

Net yield: 7.4%

The secondary buyer:

Deployed 38% less capital

Generated 180% more cash flow

Achieved 4.5x better cash-on-cash return

And I haven't even factored in the refinancing opportunity. The secondary buyer can refinance after Year 2 with documented income, extract equity, and deploy into another property.

The off-plan buyer is still waiting for handover.

Who Buys Off-Plan (And Why)

I'm not saying everyone who buys off-plan is wrong. There are legitimate reasons:

Personal use: You want a specific unit in a specific building for your own residence. Timeline and yield don't matter.

Speculation: You're betting on appreciation and plan to flip before handover. This is gambling, not investing—but it's a conscious choice.

Emotional purchase: You fell in love with the renders and the lifestyle vision. That's fine if you can afford it.

Tax structuring: Some buyers use payment plans for specific tax or estate planning purposes.

But if you're investing for yield? For cash flow? For building a portfolio that generates passive income?

Off-plan is almost never the answer.

The data is clear. The incentives are misaligned. The math doesn't work.

The Exception That Proves The Rule

I'll be fair: there are rare off-plan opportunities that work for yield-focused investors.

They require:

Genuine developer distress (not manufactured "limited time" urgency)

Pricing at or below secondary market comparables

Location with established demand (not "future potential")

Developer with track record of on-time, on-spec delivery

Payment structure that doesn't trap capital

In 9 years of investing in Dubai, I've seen maybe 3 off-plan deals that met these criteria.

Three. Out of hundreds pitched to me.

The odds aren't in your favor.

The Framework: How to Evaluate Any Dubai Deal

Here's the mental model I use:

Step 1: Check the secondary market first

Before looking at any off-plan, search DXB Interact for comparable secondary units in the same area. What are ready properties actually trading for?

If off-plan is priced more than 10% above secondary comparables, walk away.

Step 2: Calculate the true timeline cost

Add up every month of zero income between your first payment and first rental receipt. Multiply by your monthly opportunity cost (what that capital would earn elsewhere).

Most off-plan deals have 40-50 months of dead capital.

Step 3: Verify the agent's incentive

Ask directly: "What's your commission on this deal versus a secondary market property?"

If they won't answer, you have your answer.

Step 4: Demand operating history

For secondary properties, you can see actual rental data. For off-plan, you're relying on projections.

Never trust projections.

Step 5: Stress test the exit

If you needed to sell in Year 3, what would happen?

Off-plan: You're selling an uncompleted unit in competition with the developer. Good luck.

Secondary: You're selling an income-generating asset with proven tenant demand.

Liquidity matters more than people realize.

The Bottom Line

Off-plan is a wealth transfer mechanism.

It transfers wealth from investors who trust projections to developers who control outcomes and agents who profit from the transaction.

The 91% premium in Dubai Marina tells the story. Off-plan buyers are paying almost double for the privilege of waiting 3-4 years to start earning.

Meanwhile, secondary market investors are:

Collecting rent immediately

Building operating history

Refinancing to scale

Actually compounding wealth

I stopped buying off-plan after my first mistake. The data I've compiled since then confirms what I learned the hard way.

This isn't about being contrarian. It's about doing math that most investors don't do.

The agent ecosystem is designed to push off-plan because that's where commissions are highest. Your job as an investor is to recognize the incentive misalignment and act accordingly.

Secondary market. Older buildings. Prime locations. Premium renovations.

That's the formula that generates 10%+ net returns.

Everything else is marketing.

For serious investors:

I work with a small group of investors who understand why secondary market acquisitions outperform off-plan speculation.

We source undervalued properties in prime locations, renovate to premium standard, and operate using blended rental strategies that maximize yield while maintaining liquidity.

Investor to investor. Not agent to buyer.

If you're deploying meaningful capital and want to avoid the mistakes I made, let's talk.

Related Articles

View all

How to Find 10-13% ROI Rental Properties in Dubai: An Investor's Framework

Learn the exact 11-step framework for finding Dubai rental properties yielding 10-13% ROI. From an active investor with 9 properties—not another agent pitch. Dubai rental property ROI, Dubai Airbnb investment, Dubai real estate investment strategy, high-yield Dubai property, Dubai short-term rental returns

8 min read

Why Dubai Long-Term Rentals Are a Trap for Serious Investors (And What Actually Works)

Dubai's tenant protection laws strip landlords of control. Learn why savvy investors are abandoning long-term rentals—and the asset control strategy delivering 10%+ returns instead.

8 min read

The Dubai Safety Net: How High-Net-Worth Investors Build 10%+ Tax-Free Cash Flow

A framework for $10M+ investors to build tax-free, cash-flowing real estate portfolios in Dubai. From an investor with multi-8-figure holdings—not another agent pitch.

9 min read