There's a signal in the data that most investors miss entirely.

When prices drop while transaction volume increases, it means one thing: informed buyers are accumulating.

I pulled the DXB Interact numbers for Business Bay last week. Specifically Aykon City — one of the area's flagship developments.

Here's what I found:

Median price per sqft: 1,860 AED (-8% YoY) Transaction volume: 82 deals (+58% YoY)

Prices down. Transactions up.

That's not a market in distress. That's a market where smart money is positioning while retail investors chase the same tired Marina and Palm narratives.

Let me show you why Business Bay deserves your attention right now.

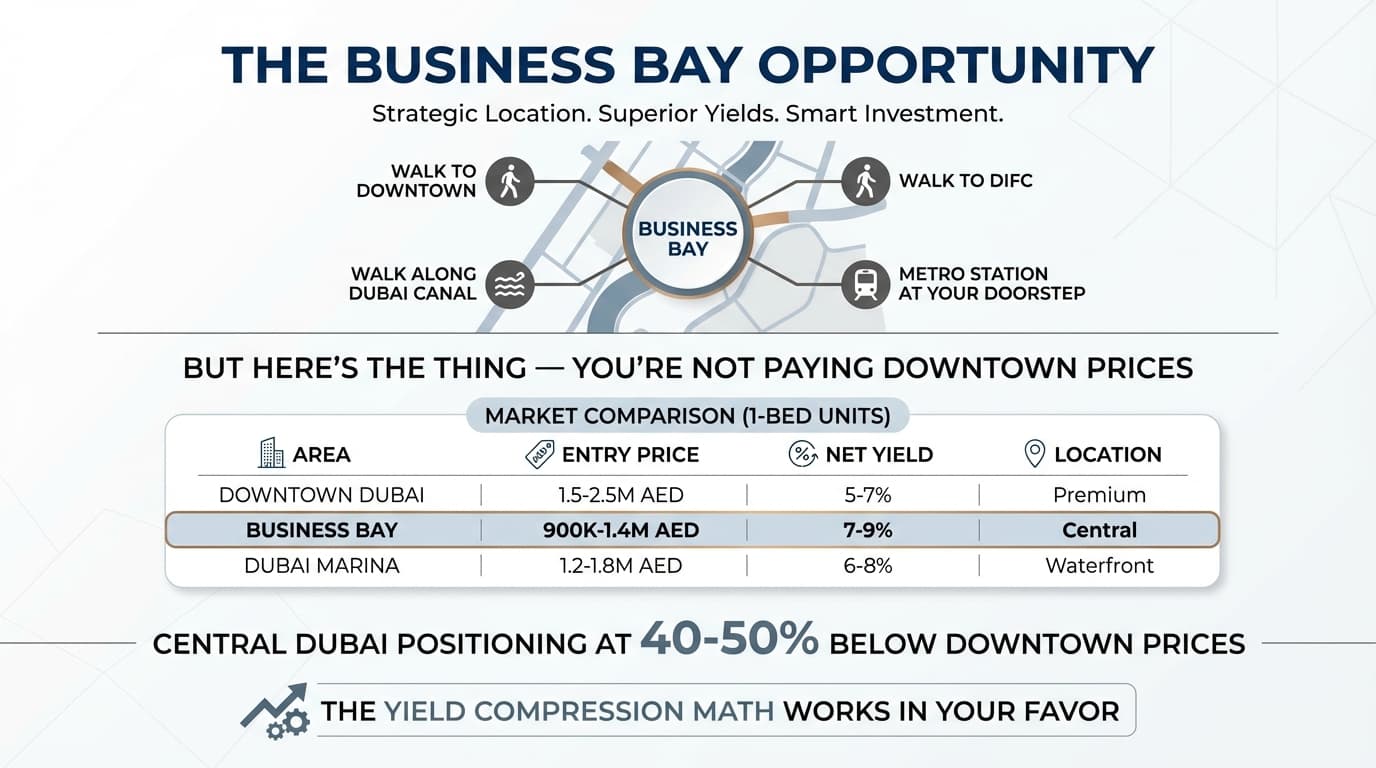

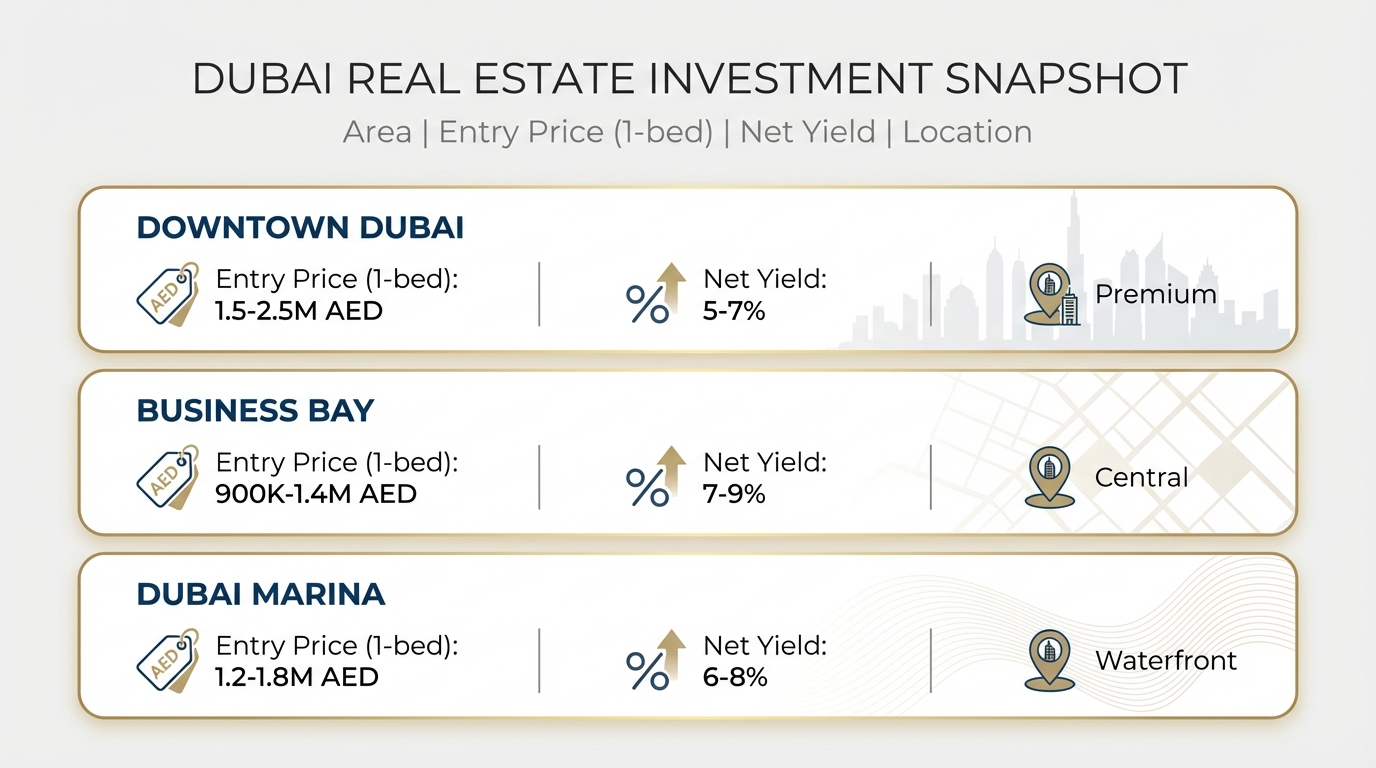

The Business Bay Opportunity

Business Bay sits in the geographic center of Dubai's commercial core.

Walk to Downtown. Walk to DIFC. Walk along the Dubai Canal. Metro station at your doorstep.

But here's the thing — you're not paying Downtown prices.

Business Bay gives you central Dubai positioning at 40-50% below Downtown prices.

The yield compression math works in your favor.

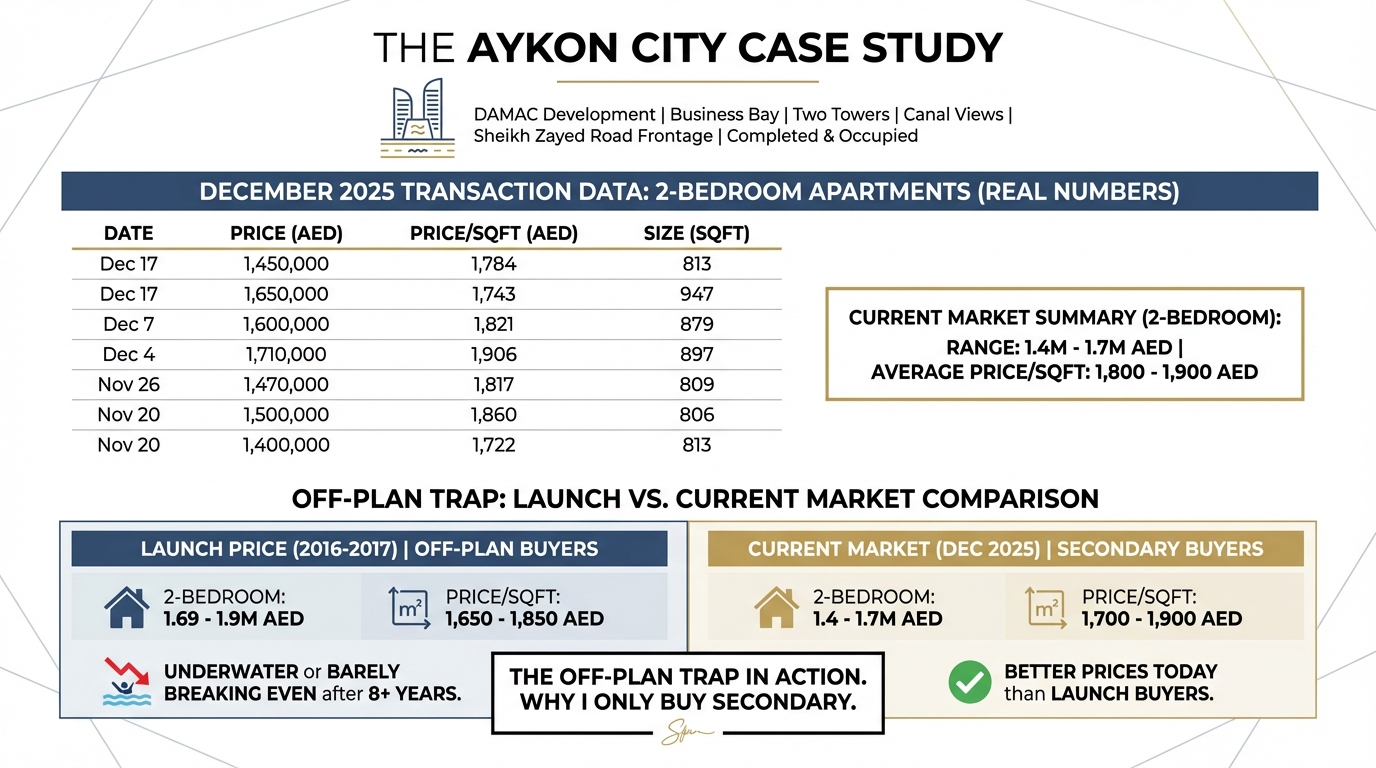

The Aykon City Case Study

I want to walk through real numbers from actual transactions.

Aykon City is a DAMAC development in Business Bay. Two towers. Canal views. Sheikh Zayed Road frontage. Completed and occupied.

Here's what the December 2025 transaction data shows:

2-Bedroom Apartments (Most Common):

DatePricePrice/SqftSizeDec 171,450,0001,784813 sqftDec 171,650,0001,743947 sqftDec 71,600,0001,821879 sqftDec 41,710,0001,906897 sqftNov 261,470,0001,817809 sqftNov 201,500,0001,860806 sqftNov 201,400,0001,722813 sqft

The range: 1.4M - 1.7M AED for 2-bedroom units Average price/sqft: 1,800-1,900 AED

Now compare this to what off-plan buyers paid at launch (2016-2017):

Unit TypeLaunch PriceCurrent Market2-Bedroom1.69-1.9M AED1.4-1.7M AEDPrice/sqft at launch1,650-1,8501,700-1,900

Off-plan buyers from 2016 are underwater or barely breaking even after 8+ years.

Secondary market buyers today are getting better prices than people who "got in early."

This is the off-plan trap in action. And it's why I only buy secondary.

Why Business Bay Yields Work

The math is straightforward:

Lower entry price + strong rental demand = higher yield

Business Bay 2-bedroom:

Purchase: 1,500,000 AED

Annual rent: 100,000-130,000 AED

Gross yield: 6.7-8.7%

Downtown 2-bedroom:

Purchase: 2,500,000+ AED

Annual rent: 130,000-180,000 AED

Gross yield: 5.2-7.2%

You're paying 40% less for units that rent at only 20% less.

That's how yield compression works in your favor.

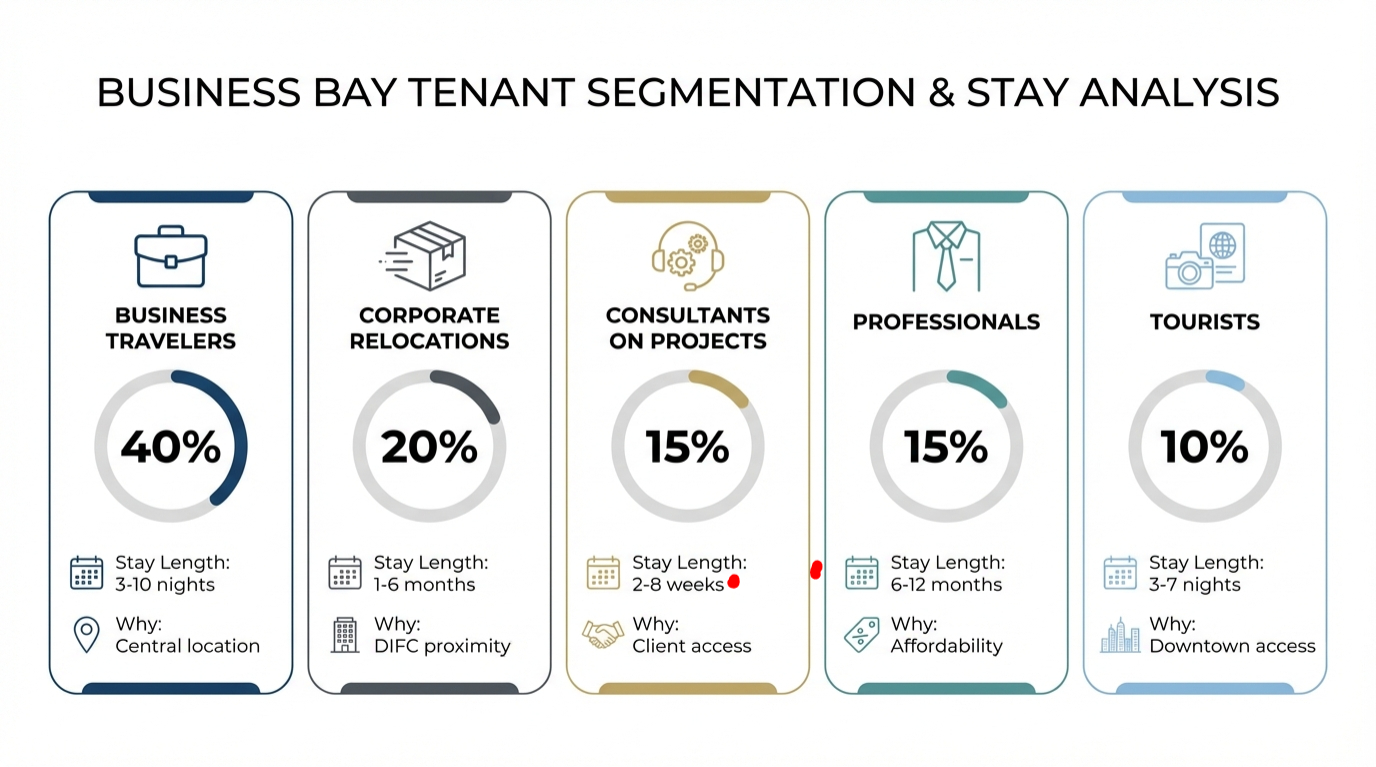

The Tenant Profile Advantage

Business Bay has something Marina and Downtown don't: corporate tenant dominance.

Why this matters:

Corporate tenants book longer stays. They expense accommodations. They don't haggle on price the way leisure tourists do.

A consultant on a 6-week project doesn't care if your nightly rate is 50 AED higher than the cheapest option. They care about location, WiFi, and a proper workspace.

This is why Business Bay operators consistently outperform purely tourist-focused areas on a net basis.

The Weekday Advantage

Here's something most investors don't think about:

Marina and Palm are weekend destinations. Tourists arrive Thursday, leave Sunday.

Business Bay is a weekday destination. Corporate travelers arrive Sunday, leave Thursday.

The result: Business Bay maintains occupancy when tourist areas have gaps.

Business Bay fills the weekday gaps that kill monthly revenue in tourist areas.

For blended STR/monthly strategies, this consistency matters enormously.

What I Look For in Business Bay

Not all Business Bay buildings perform equally. The area is large and quality varies significantly.

Buildings that work (7-9% net achievable):

BuildingEntry PriceWhy It WorksAykon City (Tower B & C)1.4-2MCanal views, solid finishesVolante Tower1-1.5MDirect canal, newerUbora Towers850K-1.2MValue play, Tower 1 canal sideExecutive Towers800K-1.1MEstablished, proven demandBay Square750K-1MRetail below, good amenities

What I avoid:

Buildings far from the canal (lose the view premium)

Very old towers with dated finishes

Areas with ongoing construction (noise complaints kill reviews)

Churchill Towers (dated, management issues)

The sweet spot: Canal-facing units in mid-range buildings. You get the view premium without paying Address or Paramount prices.

The Canal Factor

The Dubai Canal changed Business Bay's identity.

Before the canal: generic office district with some residential After the canal: waterfront living with pedestrian promenade

Properties with canal views command 15-20% higher rates than identical units facing other directions.

This view premium exists in both long-term and short-term rentals. Tenants will pay for it. Guests will pay for it.

When I'm evaluating Business Bay properties, canal view is the first filter.

Real Investment Scenario

Let me walk through actual numbers:

Acquisition:

Building: Aykon City Tower C, 2-bedroom

Purchase price: 1,450,000 AED (near bottom of current range)

Renovation: 45,000 AED (kitchen refresh, modern furniture)

Transfer fees + closing: 65,000 AED

Total investment: 1,560,000 AED

Operations (Blended Strategy):

Peak season (Oct-Apr): 65% of year

Occupancy: 85%

ADR: 480 AED

Revenue: 95,000 AED

Off-peak (May-Sep): 35% of year

Occupancy: 70%

ADR: 320 AED

Revenue: 28,500 AED

Gross annual revenue: 123,500 AED

Operating costs (48%):

Platform fees: 18,500 AED

Cleaning: 12,000 AED

Service charges: 14,000 AED

DEWA: 7,500 AED

Maintenance: 4,500 AED

Licenses: 7,500 AED

Other: 5,000 AED

Total: 59,000 AED

Net operating income: 64,500 AED Net yield: 4.1%

With professional operations (our approach):

ADR premium: +12%

Occupancy improvement: +5%

Gross revenue: 142,000 AED

Operating costs: 68,000 AED

Net income: 74,000 AED

Net yield: 4.7%

The Price Correction Opportunity

Here's why I'm paying attention to Business Bay right now:

Aykon City data:

Prices: -8% YoY

Transactions: +58% YoY

When prices drop while volume increases, informed buyers are accumulating.

This isn't a distressed market. It's a market where:

Motivated sellers (investors who bought at launch finally accepting reality)

Informed buyers (people who understand yield math)

Price discovery (market finding true value after off-plan premium deflates)

The best buying opportunities happen when retail sentiment is lukewarm but transaction data shows accumulation.

That's Business Bay right now.

Who Business Bay Is For

Business Bay makes sense if:

You're optimizing for yield over prestige

You want central Dubai location without Downtown prices

Corporate tenant demand appeals to you

You have 900K-1.5M AED to deploy

You value weekday occupancy consistency

Business Bay doesn't make sense if:

Beach proximity is essential

Tourist appeal is your primary strategy

You need the "Marina" or "Palm" address

You're buying primarily for personal use

The Bottom Line

Business Bay is Downtown Dubai's practical neighbor.

You sacrifice the Burj Khalifa address and some prestige. You gain 40% lower entry prices and 1-2% higher yields.

The data shows prices correcting while transaction volume surges. Smart money is positioning.

The question is whether you'll recognize the signal or keep chasing the same overpriced areas everyone else is fighting over.

For investors who see the opportunity:

I work with a select group of investors who understand yield math and want to execute correctly in Business Bay and other high-performing Dubai areas.

Secondary market only. Below-market acquisitions from motivated sellers. Professional operations.

Investor to investor. Not agent to buyer.